How to Use a Loan Payment Calculator to Calculate Your Payments

작성자 정보

- Christopher 작성

- 작성일

본문

Introduction:

Are you contemplating taking out a loan or refinancing an current loan? If so, a mortgage cost calculator is normally a great tool to help you estimate your monthly payments and the total value of the mortgage. In this text, we’ll explore how a mortgage fee calculator works and tips on how to use one to calculate your mortgage funds.

What Is a Loan Payment Calculator?

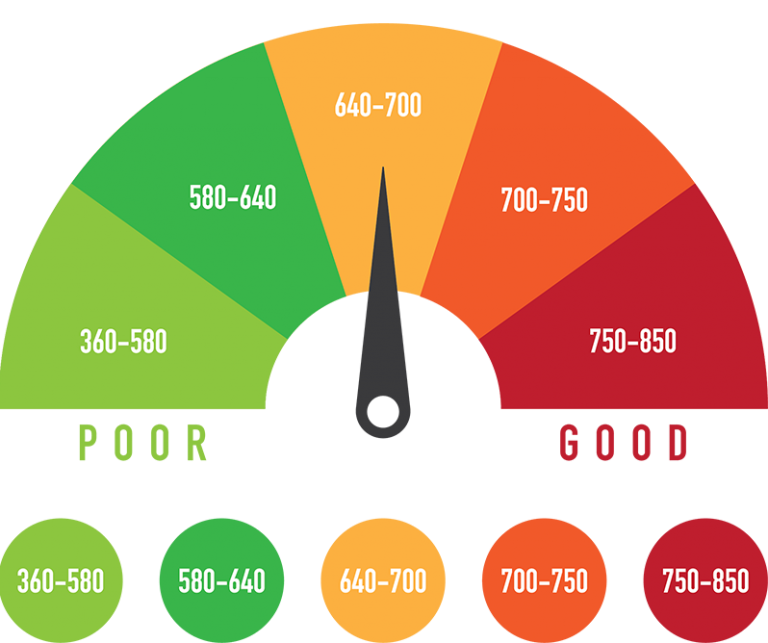

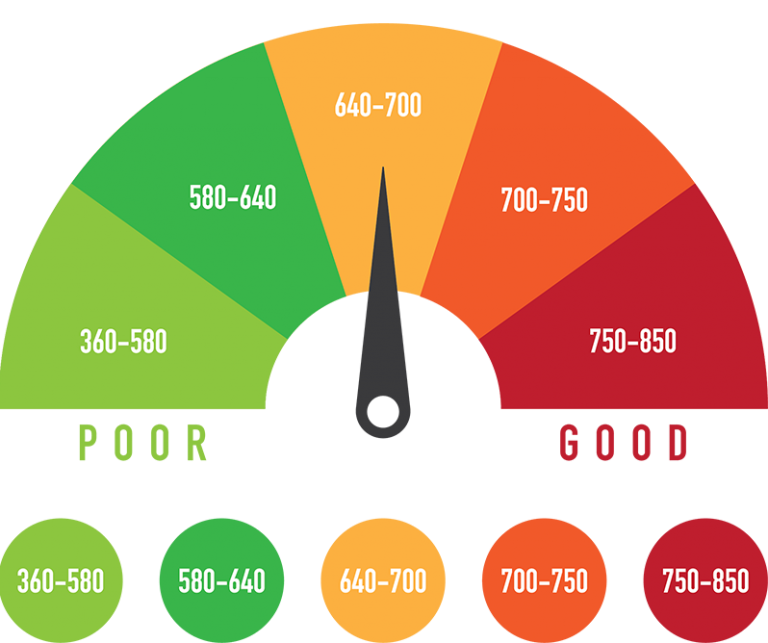

A mortgage fee calculator is a software that lets you estimate your monthly funds and the whole price of a mortgage. When you enter your mortgage amount, Conseils essentiels pour améliorer la score de crédit interest rate, and mortgage time period, the calculator will calculate your month-to-month payment and the whole value of the mortgage.

How Does a Loan Payment Calculator Work?

A mortgage cost calculator works by taking the mortgage quantity, interest rate, and loan term and utilizing these values to calculate your month-to-month funds and the entire price of the mortgage. The calculator takes into consideration the interest rate and the length of the mortgage to calculate the total price of the mortgage and the month-to-month funds.

How to Use a Loan Payment Calculator to Calculate Payments:

Using a loan payment calculator to calculate your loan payments is relatively straightforward. Generally, all you should do is enter the mortgage amount, interest rate, and loan time period. Once you’ve entered the values, the calculator will calculate your month-to-month funds and the whole cost of the mortgage.

Using a Loan Payment Calculator to Calculate Mortgage Payments:

If you’re looking to calculate the month-to-month payments and total cost of a mortgage, a mortgage fee calculator is often a great tool. To use a loan fee calculator to calculate mortgage payments, you’ll have to enter the loan quantity, rate of interest, and loan time period. The calculator will then calculate the monthly funds and Pretheure.com the whole price of the mortgage.

Using a Loan Payment Calculator to Calculate Refinance Payments:

If you’re looking to refinance an current loan, a mortgage fee calculator could be a useful tool to assist you estimate the monthly funds and the whole value of the mortgage. To use a mortgage cost calculator to calculate refinance payments, you’ll must enter the mortgage quantity, interest rate, and loan term. The calculator will then calculate the month-to-month funds and https://www.Pretheure.com/ the entire value of the loan.

Conclusion:

A loan fee calculator can be a useful tool that will help you estimate the month-to-month payments and complete value of a loan. By entering the loan quantity, rate of interest, and loan time period, the calculator will calculate your monthly payments and the entire price of the loan. Whether you’re considering taking out a mortgage, refinancing an current mortgage, or calculating mortgage payments, a mortgage payment calculator could be a great tool.

Are you contemplating taking out a loan or refinancing an current loan? If so, a mortgage cost calculator is normally a great tool to help you estimate your monthly payments and the total value of the mortgage. In this text, we’ll explore how a mortgage fee calculator works and tips on how to use one to calculate your mortgage funds.

What Is a Loan Payment Calculator?

A mortgage fee calculator is a software that lets you estimate your monthly funds and the whole price of a mortgage. When you enter your mortgage amount, Conseils essentiels pour améliorer la score de crédit interest rate, and mortgage time period, the calculator will calculate your month-to-month payment and the whole value of the mortgage.

How Does a Loan Payment Calculator Work?

A mortgage cost calculator works by taking the mortgage quantity, interest rate, and loan term and utilizing these values to calculate your month-to-month funds and the entire price of the mortgage. The calculator takes into consideration the interest rate and the length of the mortgage to calculate the total price of the mortgage and the month-to-month funds.

How to Use a Loan Payment Calculator to Calculate Payments:

Using a loan payment calculator to calculate your loan payments is relatively straightforward. Generally, all you should do is enter the mortgage amount, interest rate, and loan time period. Once you’ve entered the values, the calculator will calculate your month-to-month funds and the whole cost of the mortgage.

Using a Loan Payment Calculator to Calculate Mortgage Payments:

If you’re looking to calculate the month-to-month payments and total cost of a mortgage, a mortgage fee calculator is often a great tool. To use a loan fee calculator to calculate mortgage payments, you’ll have to enter the loan quantity, rate of interest, and loan time period. The calculator will then calculate the monthly funds and Pretheure.com the whole price of the mortgage.

Using a Loan Payment Calculator to Calculate Refinance Payments:

If you’re looking to refinance an current loan, a mortgage fee calculator could be a useful tool to assist you estimate the monthly funds and the whole value of the mortgage. To use a mortgage cost calculator to calculate refinance payments, you’ll must enter the mortgage quantity, interest rate, and loan term. The calculator will then calculate the month-to-month funds and https://www.Pretheure.com/ the entire value of the loan.

Conclusion:

A loan fee calculator can be a useful tool that will help you estimate the month-to-month payments and complete value of a loan. By entering the loan quantity, rate of interest, and loan time period, the calculator will calculate your monthly payments and the entire price of the loan. Whether you’re considering taking out a mortgage, refinancing an current mortgage, or calculating mortgage payments, a mortgage payment calculator could be a great tool.

관련자료

-

이전

-

다음작성일 2025.04.02 17:45

댓글 0

등록된 댓글이 없습니다.